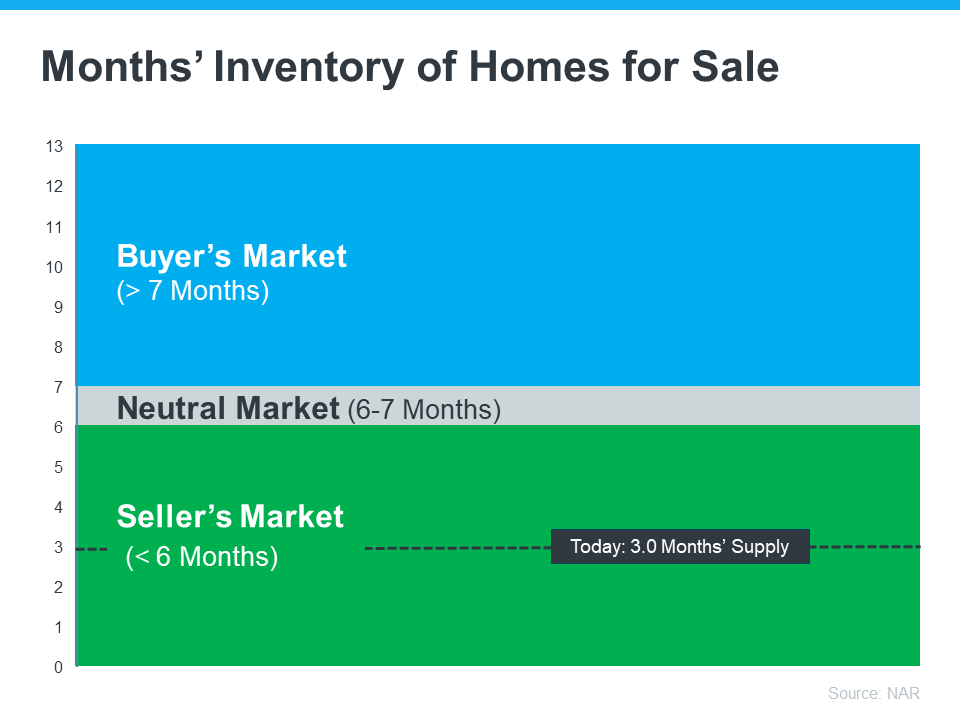

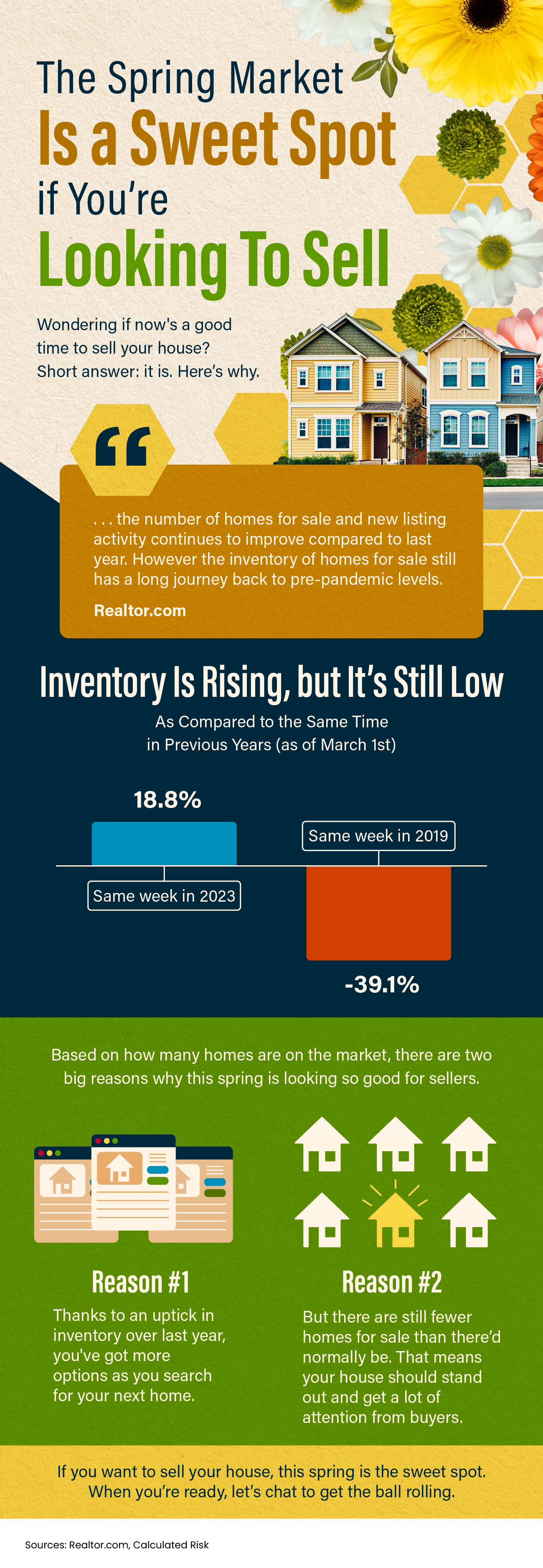

Thinking about selling your house and wondering if now’s a good time to do it? Here’s what you need to know. Even though the number of homes for sale has been growing this year, there still aren’t enough homes on the market for all the buyers who want to buy.

So, what does that mean for you? To keep it simple, it means it’s still a seller’s market. Here’s how it works:

- A neutral market is when supply and demand is balanced. Basically, there are enough homes to meet buyer demand based on the current sales pace, and home prices hold fairly steady.

- A buyer’s market is when there are more homes for sale than there are buyers. When that happens, buyers have more negotiation power because sellers are willing to make compromises to close the deal. In a buyer’s market, sellers may have to do price cuts to re-ignite interest in their home, and prices may go down. But we haven’t seen this for years since there are so few homes available to buy.

- In a seller’s market, it’s just the opposite. When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find homes to purchase. That creates increased competition among purchasers which can lead to more bidding wars. And if buyers know they may be entering a bidding war, they’re going to do their best to submit a very attractive offer upfront. This could drive the final sale price of your house up.

The graph below uses data from the National Association of Realtors to show just how deep into seller’s market territory we still are today:

What Does This Mean for You?

The market is still working in your favor. If you lean on an agent for advice on how to get your house list ready and how to price it competitively, it should get a lot of attention from eager buyers. That means you’ll likely get multiple offers and see your house sell quickly and for top dollar. As a recent article from Ramsey Solutions explains:

“A seller’s market is when demand for homes is higher than the supply of homes. And that’s still the case right now. If you’re planning to sell your house, you can expect to sell it fairly quickly for close to your asking price—as long as your asking price is realistic for the current market.”

Bottom Line

Today’s housing market still favors sellers. If you’re ready to sell your house, connect with a local real estate advisor so you can start making your moves.

![The Spring Market Is a Sweet Spot if You’re Looking To Sell [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240307/20240308-The-Spring-Market-Is-a-Swet-Spot-for-Homeowners-Looking-to-Sell-KCM-Share.png)

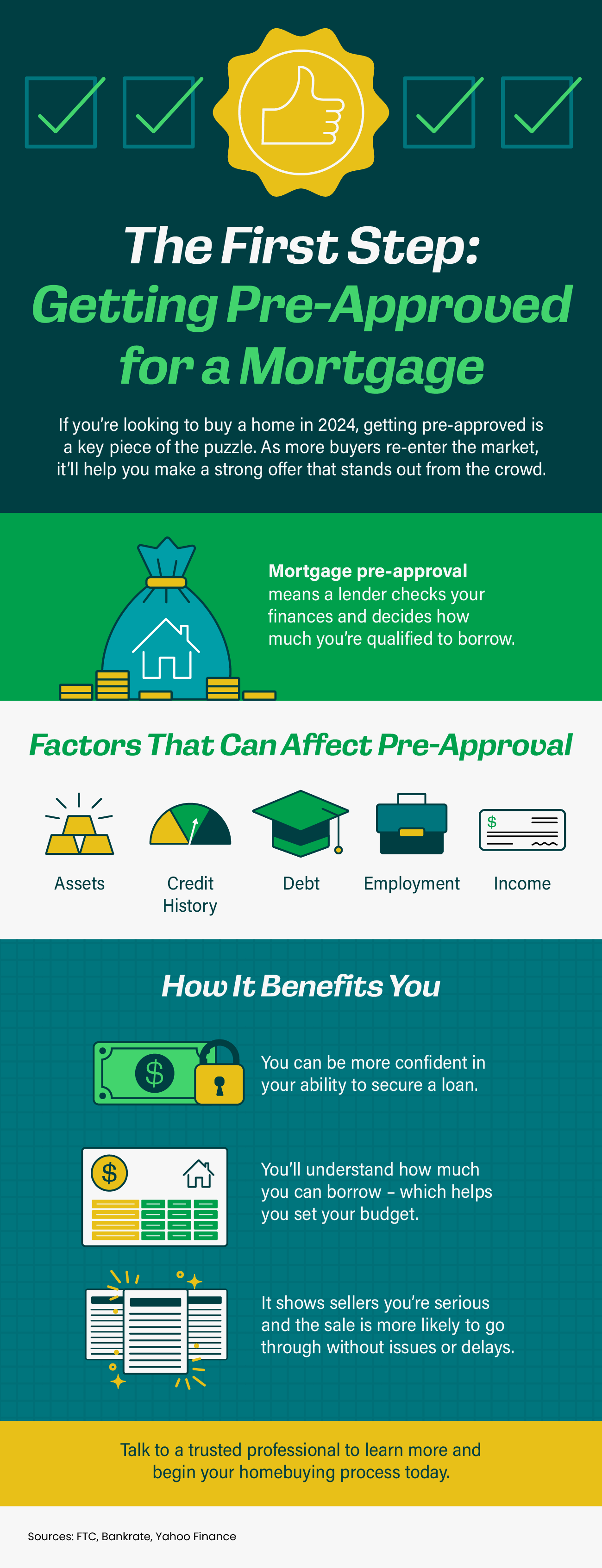

![The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240229/The-First-Step-Getting-Pre-Approved-for-a-Mortgage-KCM-Share.png)